Key findings

- Financial Insecurity in Crises: While 80% of entrepreneurs save for their business, only 16% would use business savings to recover from a crisis. Others instead rely on household savings or borrowing, which may limit the ability of the business to recover in the long-term.

- Limited Access to Credit: 27% of women entrepreneurs lack the financial resources needed to grow. High interest rates (49%), low loan amounts (23%), and short loan terms (14%) create barriers to formal financing, and debt stress remains particularly high in Pakistan, where 94% of borrowers are “very concerned” about repayment.

- Digital Divides: While 94% of respondents own a smartphone, only 51% use digital tools for their business. Access to digital upskilling remains a challenge, limiting women’s ability to tap into online financial services and expand into new markets.

- Satisfied but Stressed: While many cite satisfaction with the state of their business, households, and finances, this may come at the cost of high levels of stress. However, when spouses were involved in decision-making, women were 27 percentage points less likely to “always worry” about their business and 23 percentage points less likely to “always worry” about their household.

- Disconnected from Support Networks: One-third (34%) of women entrepreneurs lack access to networks like peer groups and mentors for business advice.

These findings uncover reality: women entrepreneurs want to grow their businesses– but they need systems that work with their realities, not against them.

“This research highlights how financial health is about much more than income or confidence—it’s about navigating complex systems, balancing roles, and accessing the right mix of resources,” said Rathi Mani-Kandt, Director of Women’s Entrepreneurship at CARE. “When we listen to women and design systems that match their realities, we don’t just improve business outcomes—we build more resilient economies.”

“These insights reinforce that unlocking women’s economic potential requires programs and systems to see and support the whole person,” said Payal Dalal, executive vice president for global programs at the Mastercard Center for Inclusive Growth. “Through Strive Women, we are investing in the tools, networks, and insights that can drive lasting impact for women entrepreneurs around the world.”

What needs to change?

The Strive Women research findings call for bold, practical, women-centered interventions. To ensure women entrepreneurs can thrive, CARE is calling for:

- Offering long-term, higher-interest savings accounts with features like automated deposits to help women build emergency funds.

- Financial products tailored to women’s business needs, with larger loan sizes, flexible repayment terms and alternative credit assessments.

- Offering tiered, practical digital literacy programs, from mobile banking basics to advanced tools like e-commerce and AI.

- Creating peer groups and family-inclusive workshops to build networks, mentorship, and shared responsibility at home.

- Innovations that support redistributive care responsibilities, through mechanisms such as subsidized childcare and financial tools designed with caregiving realities in mind.

Looking ahead

As Strive Women programming continues, further research will explore how tailored financial and business support can build long-term resilience, how digital tools support business growth, and how strong networks—both personal and professional—can enhance women’s financial health and overall well-being.

Notes to editors:

Link to Strive Women Baseline Report

Link to Baseline Learning Summary

For media inquiries, please email usa.media@care.org

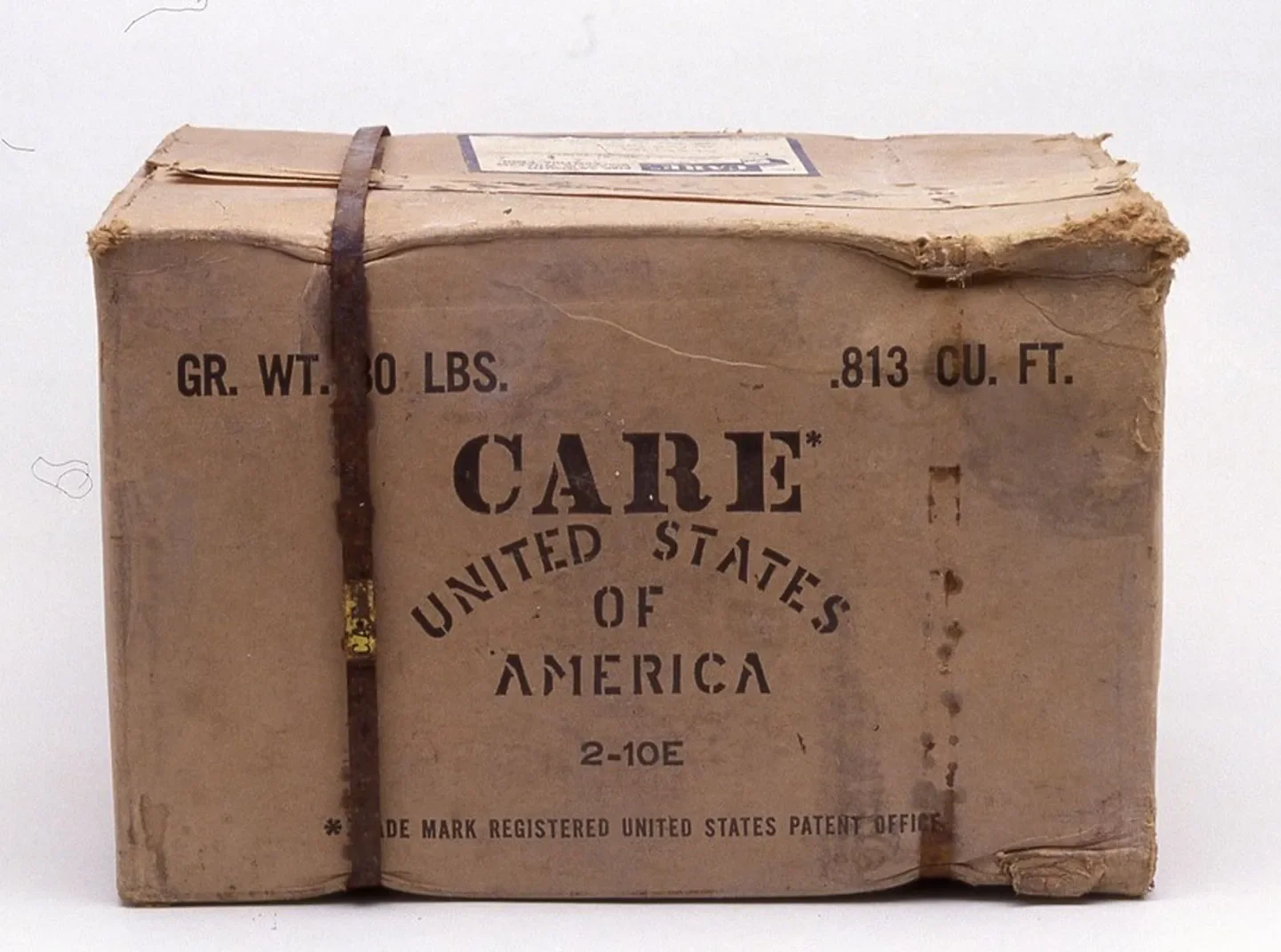

About CARE: Founded in 1945 with the creation of the CARE Package®, CARE is a leading humanitarian organization fighting global poverty. CARE places special focus on working alongside women and girls. Equipped with the proper resources women and girls have the power to lift whole families and entire communities out of poverty. In 2023, CARE worked in 109 countries, reaching 167 million people through more than 1,600 projects.

About the Mastercard Center for Inclusive Growth

The Mastercard Center for Inclusive Growth advances equitable and sustainable economic growth and financial inclusion around the world. The Center leverages the company’s core assets and competencies, including data insights, expertise, and technology, while administering the philanthropic Mastercard Impact Fund, to produce independent research, scale global programs, and empower a community of thinkers, leaders, and doers on the front lines of inclusive growth. For more information and to receive its latest insights, follow the Center on LinkedIn, Instagram and subscribe to its newsletter.